2025 GCGC CONFERENCE:

LONDON

GLOBAL CORPORATE GOVERNANCE COLLOQUIUM (GCGC) 2025

Friday, 13 June 2025 (08:45 – 16:30 BST)

Saturday, 14 June 2025 (09:00 - 16:45 BST)

Location

Imperial Business School, London

Note: This was an invitation-only event

About the event

The eleventh annual GCGC Conference was hosted by Imperial Business School on 13 -14 June 2025 in London.

GCGC 2025, hosted by Imperial College London, gathered leading scholars and practitioners to explore frontier issues in corporate governance under conditions of rapid economic, political, and technological change. Across paper sessions, panel discussions, and prize presentations, the event examined governance at the intersections of geopolitics, sustainability, market structure, and corporate law.

A recurring theme was the interaction between corporate governance and political economy. Several papers considered the influence of political control on state-owned enterprises, the shifting boundaries between antitrust and ESG, and the role of corporate governance in an era of geoeconomics. The Corporate Governance in an Era of Geoeconomics session explored how boards and regulators adapt to geopolitical risks, while The EU’s Sustainability Due Diligence Directive panel debated the practical challenges of implementing wide-reaching regulatory frameworks across diverse jurisdictions.

Sustainability remained a strong focus, but with increasing emphasis on its operationalisation and limits. The ESG Overperformance and Beyond ESG sessions analysed the efficacy of ESG linked compensation, highlighting how targets are often met without clear evidence of improved ESG outcomes. Sustainable Investing in Practice used survey evidence to examine how E&S factors are incorporated into portfolio decision-making, revealing the constraints and practical realities that shape integration. These discussions reflected a maturing of the ESG debate, with more attention on data, metrics, and investor mandates than in earlier years.

Another thematic thread running through the conference was the continuing evolution of capital market structures and their implications for governance. Papers such as Share Repurchase Legalization revisited long-running policy debates with new cross-country evidence, showing how capital reallocation effects challenge simple narratives about buybacks crowding out investment. Corporate Political Disclosure offered a granular look at the mechanics of shareholder proposals on political spending and lobbying, highlighting the role of sustained engagement and the interplay between investor coalitions, proxy advisors, and disclosure indices. These contributions reflected the hallmark approach of the GCGC series: blending doctrinal, empirical, and policy perspectives to reassess assumptions about market functioning.

Another theme concerned the institutional design of governance mechanisms under stress— whether from concentrated ownership, regulatory change, or technological disruption. Defying Western Expectations challenged prevailing assumptions about the absence of shareholder activism in China, while Evidence from Political Control Shift in SOEs examined investor reactions to formalised Party authority in corporate charters.

Corporate governance fundamentals also remained in focus. Venture Capital Contracting as Bargaining, Committee Decision-making, and Fixing MFW sessions addressed decision-making processes, minority protections, and legal doctrine in transactions with controlling shareholders. The Working Paper Prize session celebrated papers from Katja Langenbucher, and also Mike Burkart, Samuel Lee, and Paul Voss, each highlighting evolving governance structures in AI integration and in control transactions.

Panels explored the policy and legal dimensions

of collective investor action (Are Investor

Coalitions Cartels?) and the competitive effects

of corporate law reforms. Across sessions, the

discussion reflected a shift from broad ESG

debates toward more granular examination of

governance mechanisms—whether in takeover

markets, board processes, or stewardship

frameworks.

This event was organised by the European Corporate Governance Institute (ECGI). Questions may be directed to: admin@ecgi.org

This event is strictly by invitation only and the number of places are limited to ensure quality engagement.

2025 Conference Programme

View the conference programme and attending delegates for the 2025 Global Corporate Governance Colloquium.

Speakers

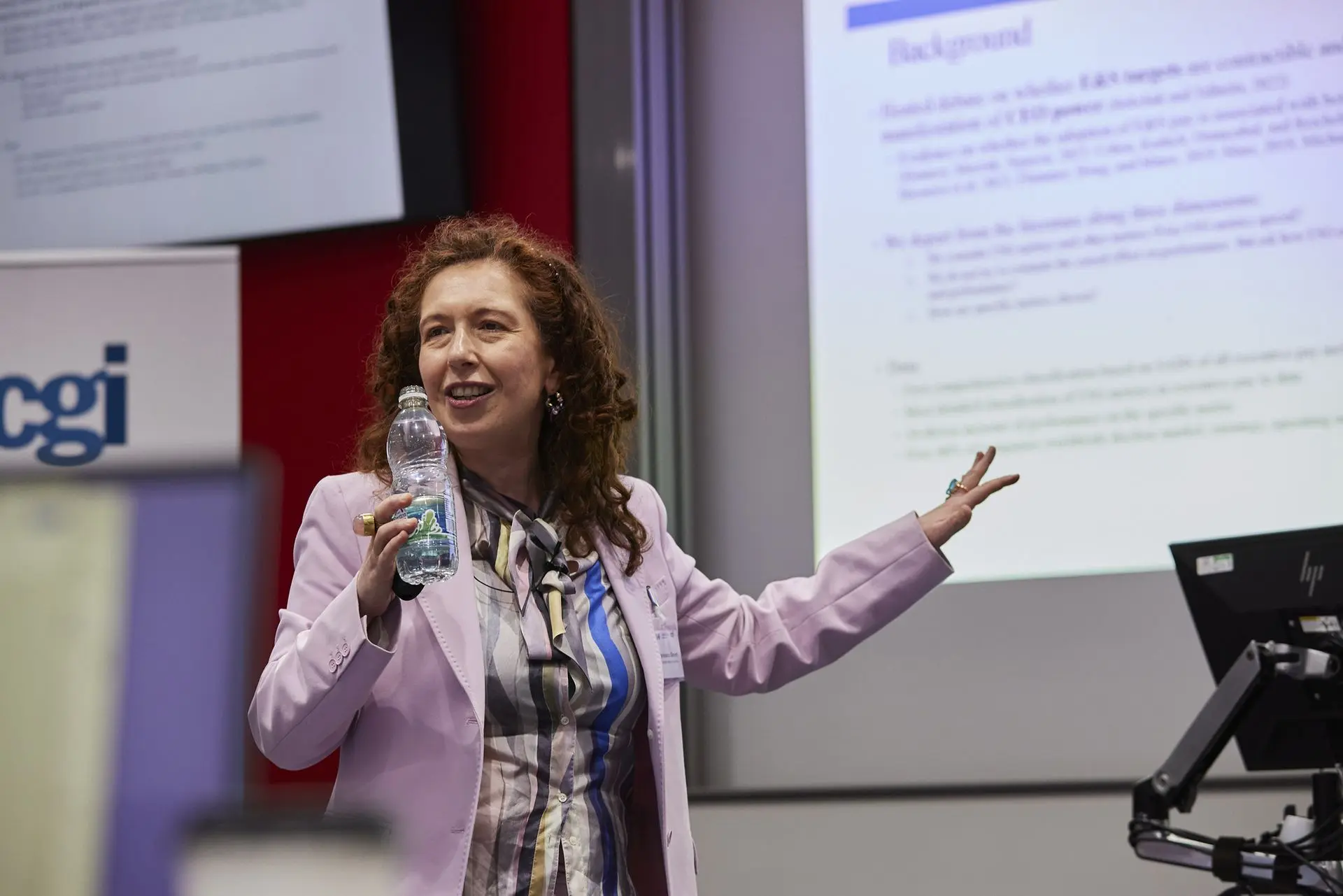

Image Gallery

Organised by